Singapore, a global financial hub renowned for its technological prowess and forward-thinking regulatory environment, presents a unique landscape for cryptocurrency enthusiasts. The allure of Bitcoin and other digital currencies has sparked a surge in interest in mining, prompting many to explore the profitability of acquiring dedicated mining equipment within the city-state. But navigating the intricacies of purchasing and deploying Bitcoin mining machines in Singapore requires careful consideration and strategic planning.

Before diving into the hardware, understanding the fundamentals of Bitcoin mining is crucial. Bitcoin mining is essentially the process of verifying and adding new transaction records to the Bitcoin blockchain. Miners use powerful computers to solve complex mathematical problems, and in return, they are rewarded with newly minted Bitcoins and transaction fees. This incentivizes miners to maintain the integrity and security of the Bitcoin network.

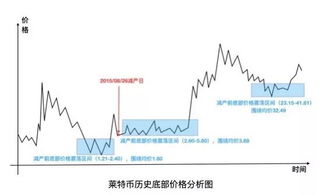

The profitability of Bitcoin mining hinges on several factors: the price of Bitcoin, the difficulty of the mining algorithm, the cost of electricity, and the efficiency of the mining hardware. Fluctuations in these variables can significantly impact the return on investment (ROI) for mining operations.

Selecting the right mining equipment is paramount. Application-Specific Integrated Circuits (ASICs) are the dominant force in Bitcoin mining. These specialized machines are designed specifically for hashing Bitcoin’s algorithm and offer significantly higher hash rates (a measure of computational power) compared to general-purpose computers. Popular ASIC manufacturers include Bitmain, MicroBT, and Canaan. When evaluating mining rigs, consider the hash rate (measured in terahashes per second – TH/s), power consumption (measured in watts), and energy efficiency (measured in joules per terahash – J/TH). A more efficient miner consumes less power while delivering a higher hash rate, translating to lower operating costs and increased profitability.

Purchasing mining equipment in Singapore can be done through various channels: direct from manufacturers, authorized distributors, and online marketplaces. Buying directly from manufacturers often offers competitive pricing, but it may involve longer lead times and potential shipping complexities. Authorized distributors provide local support and warranties, ensuring a smoother purchasing experience. Online marketplaces offer a wide selection of miners, but it’s essential to vet sellers carefully to avoid scams and counterfeit products. Always prioritize reputable vendors with established track records and positive customer reviews.

Beyond Bitcoin, alternative cryptocurrencies like Dogecoin and Ethereum, while potentially mined with different hardware (especially Ethereum, with its transition to Proof-of-Stake), offer avenues for diversification. Scrypt-based algorithms, used by Dogecoin, can be mined with ASICs, though these are often less specialized than Bitcoin miners. Ethereum, prior to its merge, relied on GPU mining, allowing individuals to use graphics cards for processing transactions and earning rewards. Exploring these alternatives requires researching the specific mining algorithms and hardware requirements for each cryptocurrency.

Electricity costs are a major consideration in Singapore, where power rates are relatively high compared to some other regions. Hosting mining equipment at home can be tempting, but it often leads to higher electricity bills and potential noise and heat issues. A more viable option is to consider mining machine hosting services. These services provide dedicated facilities with optimized power infrastructure, cooling systems, and security measures. By outsourcing the infrastructure management, miners can focus on optimizing their mining operations and maximizing their returns.

Singapore’s regulatory environment regarding cryptocurrencies is evolving. While the city-state embraces innovation, it also emphasizes consumer protection and financial stability. Before embarking on Bitcoin mining activities, it’s essential to familiarize yourself with the relevant regulations and guidelines issued by the Monetary Authority of Singapore (MAS). Ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) requirements to avoid legal complications.

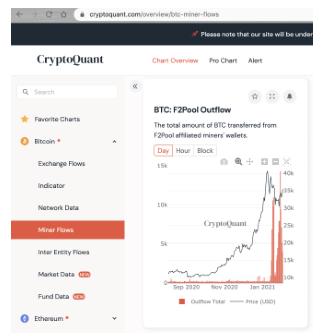

Joining a mining pool can increase the likelihood of earning Bitcoin rewards. Mining pools combine the computational power of multiple miners, increasing their chances of solving blocks and receiving payouts. Pool rewards are typically distributed proportionally to the amount of hash rate contributed by each miner. Popular mining pools include Foundry USA, AntPool, and ViaBTC. Research and select a reputable mining pool with a transparent fee structure and reliable payout history.

Investing in Bitcoin mining equipment is not without risks. The cryptocurrency market is inherently volatile, and Bitcoin prices can fluctuate dramatically. Moreover, the mining difficulty adjusts dynamically to maintain a consistent block generation rate, meaning that as more miners join the network, the competition increases, and the rewards become smaller. Thoroughly assess your risk tolerance and financial capacity before committing to a significant investment in mining hardware.

The future of Bitcoin mining is uncertain, but it’s likely to become increasingly competitive and energy-intensive. As Bitcoin’s value continues to evolve, so too will the technologies and strategies employed by miners. Staying informed about the latest advancements in mining hardware, software, and energy efficiency is crucial for maintaining profitability in the long run. Exploring renewable energy sources for powering mining operations can also enhance sustainability and reduce environmental impact.

Leave a Reply